I have long said that forecasting the inflation rate of 2022 would be difficult. Still, inflation (both actual and forecasted) will determine the timing of liftoff. Inflation in 2022 will depend on not only underlying inflation (whatever that is today) but also the persistence of various temporary factors, such as supply shortages and reopening demand.

Underlying inflation

Underlying inflation is the rate that would prevail in the absence of all temporary effects on inflation. Coming into this year, I had expected that the underlying rate of inflation would be near 2%. Judging from the 12-month trimmed-mean inflation rate, this appeared to be true. But the pace of increase in the trimmed-mean measure has picked up, and that’s caused the 12-month rate to edge up recently.

Both underlying and actual inflation in 2022 will be shaped by a combination of several forces:

A. base effects which will further raise and distort reported inflation;

B. persistent supply constraints keeping inflation elevated; and

C. normalization of demand and supply effects which will provide a disinflationary

offset.

Base effects

The high monthly readings for inflation in 2021 will remain in the 12-month window through most of 2022. They will continue to elevate inflation rates dramatically early in the year, then have a gradually diminishing effect through the rest of the year. Fortunately, base effects can be identified and adjusted for in the assessment of underlying inflation.

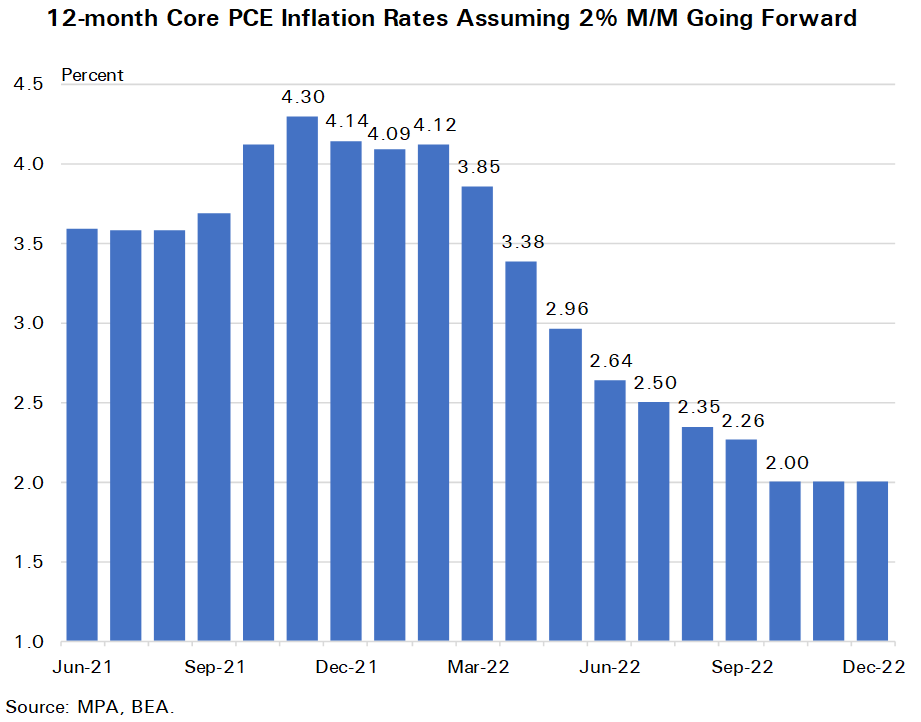

In the chart below, I assume that underlying inflation is 2%. I assume that the monthly readings for inflation would be at an annualized rate of 2% in 2022, in the absence of temporary effects. If that assumption is true, base effects would boost the inflation rate a couple percentage points in the first quarter, keeping it in the vicinity of 4%, and by a diminishing amount later in 2022.

To read more, send us a message.