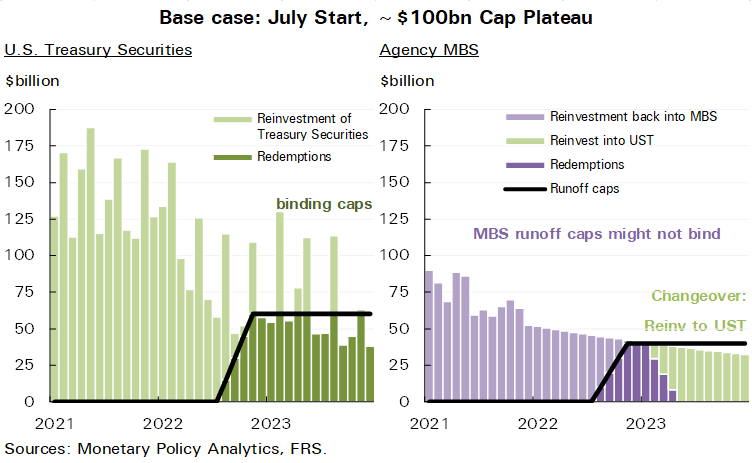

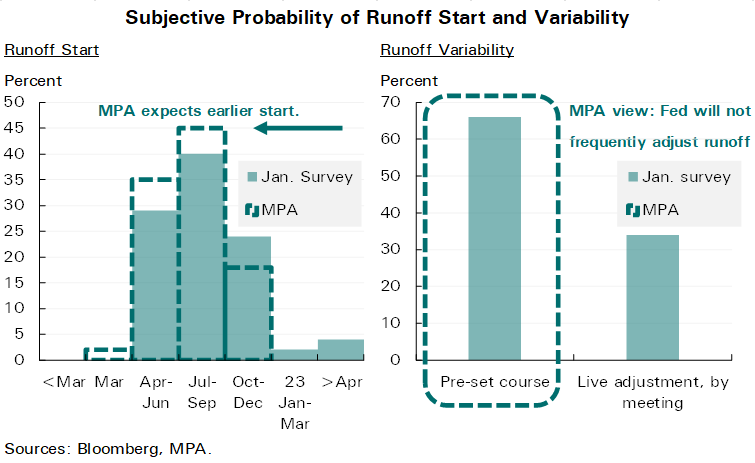

1. Runoff. In keeping with greater upside risk to the glide path, we see greater risk of an earlier and more-rapid runoff. Our base case is still a July start with ~$100bn/mo caps. The hawkish case is an earlier start and caps maxing out at higher, like $120bn/mo. A reduction of more than $1tn, e.g. by 2023, might have an effect akin to several rate hikes.

2. Escalation. Officials insist that runoff will proceed in the background once it begins, and the primary tool of policy adjustment would be speeding up or slowing down rate hikes. But the bar for revisiting the runoff plans is much lower than thought.

a) Caps. If the initial caps are already set fairly high, raising them further won’t do much to accelerate reduction because the caps no longer bind. Higher caps will not accelerate runoff if there is not more maturing in the first place. Furthermore, this scenario would likely come with a higher interest rate environment and further slow MBS prepayments.

b) Composition. The result of raising caps might increase UST runoff but not MBS runoff.

So, higher runoff caps without any offsets would tilt the portfolio to MBS more. It

would orient the FOMC in the opposite direction of its goal: a portfolio of only UST

To read more, send us a message.