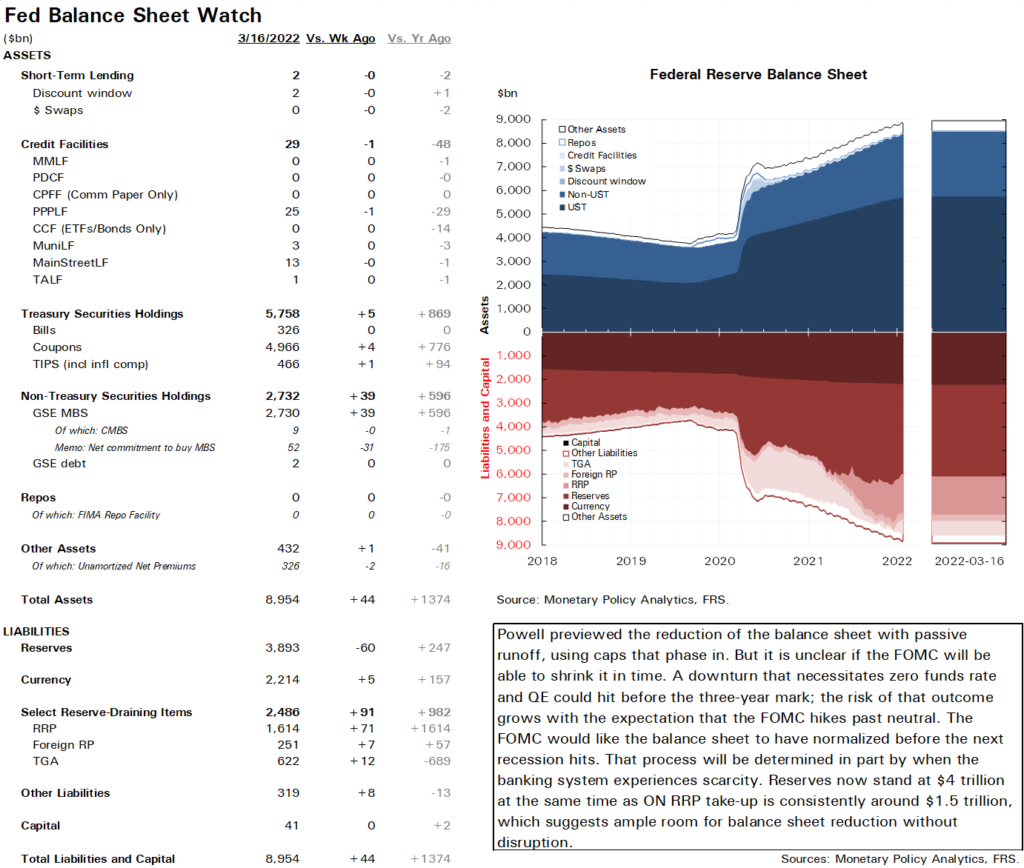

Situation. Powell previewed the reduction of the balance sheet with passive runoff, using caps that phase in. But it is unclear if the FOMC will be able to shrink it in time. A downturn that necessitates zero funds rate and QE could hit before the three-year mark; the risk of that outcome grows with the expectation that the FOMC hikes past neutral. The FOMC would like the balance sheet to have normalized before the next recession hits. That process will be determined in part by when the banking system experiences scarcity. Reserves now stand at $4 trillion at the same time as ON RRP take-up is consistently around $1.5 trillion, which suggests ample room for balance sheet reduction without disruption.

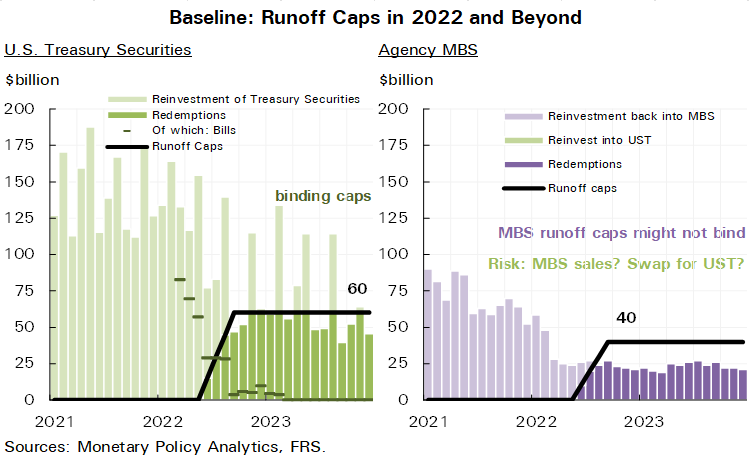

Runoff. For our policy predictions, see: Best Laid Plans. The FOMC seems to have reached agreement on “parameters” (size and phase-in schedule of runoff caps), to be presented in the March minutes on April 6. That gives them the option to announce runoff at the May meeting, or to push it off into June or later if market disruption (e.g. from geopolitics) makes it too risky.

To read more, send us a message.